The Starting Point

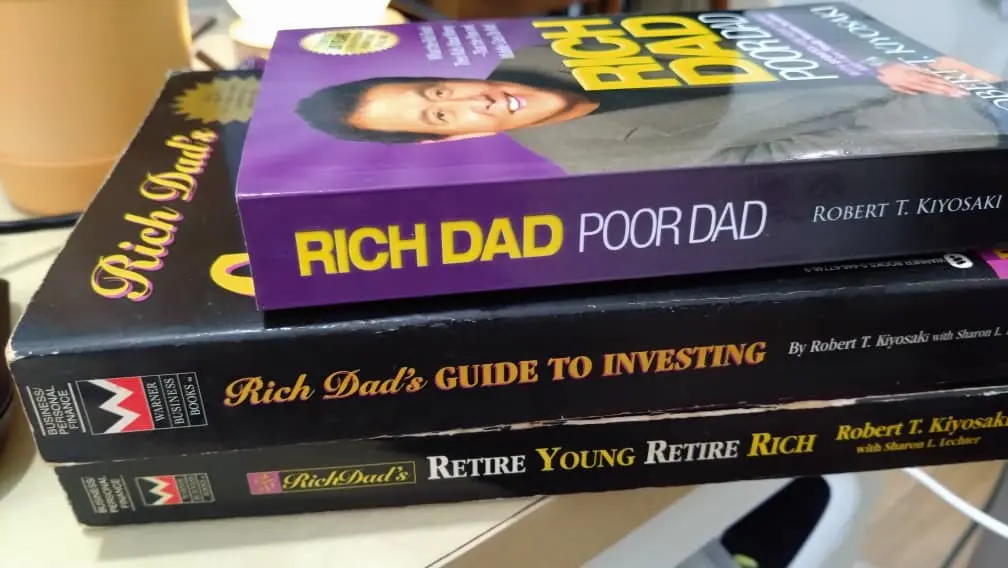

My interest in the stock market began when I picked up “Rich Dad Poor Dad” by Robert Kiyosaki from a bookstore around 1999 or 2000. The entire book was both inspiring and eye-opening about the money mindsets of “poor dad” and “rich dad” concerning financial planning. It teaches that wealth comes from financial education, investing, and creating assets, not just working for a paycheck. It got me interested in the subject of financial planning and investing. Then I bought the other first few books of his, like The Guide to Investing, Retire Young Retire Rich, and The Cashflow Quadrant. My copies of Rich Dad Poor Dad and Cashflow Quadrant are gone; I can’t recall who I lent them to.

It got me interested in investing in the local stock market, Bursa Malaysia. I opened my first stock broker account with TA Securities (hope my memory serves me right). And if I recall correctly, I didn’t even trade once with the account. All this new information got me excited, but I do not have strong enough motivation to take further action. I added to my book collection, including “How To Make Money from Your Stock Investment Even in a Falling Market” by Ho Kok Mun. I read some, but others sat on the shelf, collecting dust. The second thing I did was to attend a paid technical analysis workshop; it was a few-hour class, and I was the only student at that time.

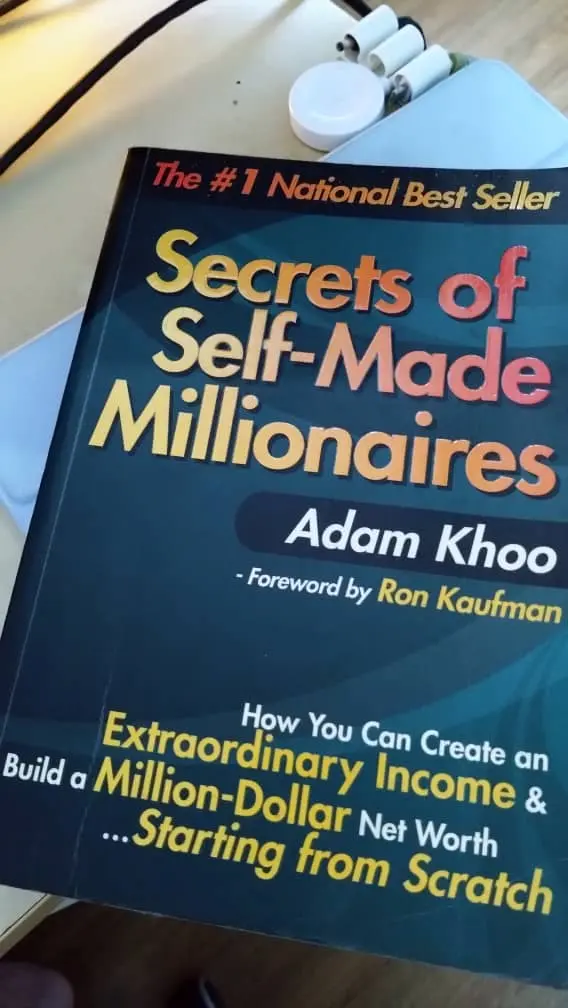

Then the idea of investing in Bursa died off, and I am back to my working routine and life. Till a few years later, I saw this book “Secrets of Self-Made Millionaires” by Adam Khoo catch my attention. I bought the book and read it. It was inspiring, especially the chapter on investing in the US stock market. It opened up my mind to the possibility of investing outside of Malaysia. I had doubts like, “What can I, a Malaysian living here, understand about the United States?” Those listed companies in US are alien to me, some concern or fear that I have. The last few pages feature the Wealth Academy Investor workshop, and it seems really interesting. I thought about going but didn’t do anything except look up the price. I am not sure why I did not attend it immediately, maybe because of the costs.

Mid-Life Career Crisis

I think for most people, after working for people for many years, they reach a stage of being kind of lost in their career context. To resign, but I need money for my bills and to put food on the table. Moving to another new career, there is a fear of whether I can do it and still perform. Moving to another company for a similar role in the same industry, I just felt bored. The idea of investing/trading is actively coming back into my mind. I went to the preview hosted by AKLTG, where Adam talked about the Wealth Academy Investor workshop, but I wasn’t able to go on the workshop date.

Then I went to another Wealth Academy Investor (WAI) preview by Adam in the year of 2014. The WAI workshop is more on value momentum investing. And the second session was on the Pattern Trader Tutorial (PTT) preview by Conrad Alvin Lim. The PTT workshop focuses on trading, including short-term and intraday strategies. During that period, Conrad was affiliated with AKLTG, actively promoting the workshop. PTT was also very interesting, and the workshop fees are higher than WAI’s partly because it is longer. I enrolled in WAI’s November 2014 workshop after wanting to attend it for a long time. I also planned to join PTT eventually.

Since the WAI workshop, I’ve avoided paper trading because it’s boring to use fake money. So I jumped straight to live trading after opening the broker account and funding it. I was active and set a goal for how much I wanted to earn per month. By the way, this was 2 of the mistakes I learned, which I will share in another post. And yes, after months of investing in the US stock market, I was making a loss. Then I stopped for a while and went back to my busy work life, and yes, in the same industry and career.

And I also invested in the Bursa, and my first two stocks that I purchased were AirAsia and AEON in 2018. Why them? Is it because they are undervalued, making a ton of money every year? I invested in AirAsia, trusting its founder’s leadership to improve the company, and in AEON, which owns my favorite store, Jusco. And yes, I lost money in both of them. I held my investments for years until recently; I sold AirAsia a few years ago and AEON a few weeks ago. Why sell it now for a loss? I am more mature now with age catching up, and after attending the Versatile Trader Package with Beyond Insights, which covers both Growth Investing eXpress and Trend & Swing Trading workshop, I knew there was no point in holding on to losing positions. It is much better to sell it off and take the money to invest in another potential stock.

Before that, I invested in MREITs and bought KIPREIT in 2019 after taking CF Lieu’s REIT Method training.

The New Chapter

As I get older, with retirement coming up and inflation rising, I have a strong motivation to pursue a new source of income through trading and eventually become a full-time trader. I participated in the VTP program by Beyond Insights, founded in Malaysia in 2008 by Kathlyn Toh and Terence Teoh. The advanced course in Dynamics Intraday Trading is essential, followed by another workshop I strongly recommend for anyone serious about becoming a professional investor or trader. It is the Master Trader Bootcamp which helps us understand our own psychology in the context of investing/trading. They are the only educator that I know in Asia to conduct psychology workshop, and it’s worth every cent of my money invested in the bootcamp.

With a STRONG WHY, I am now fully COMMITTED to my journey to BEcome a Master Trader. This is why my blog “BE Trader Diary” was born, as my diary to document my journey to BE a Master TRADER. And this serves as my own journal and only for EDUCATIONAL purposes. This is not a suggestion to buy or sell securities or to use any strategies mentioned in this blog.

Disclaimer

The information provided is for informational and education purposes only. BEtraderDiary.com makes no representations or warranties as regards the information, including but not limited to any representation or warranty as to the accuracy of the information for any specific purpose. While every effort has been made to ensure the accuracy and reliability of this article, the information should not be used to make important financial, investment, real estate, or legal decisions. This information shouldn’t replace advice from a qualified professional who understands your situation. We are not liable for any damage if you use this guidance.