Last Thursday, PLTR was one of the candidates that I planned for my intraday trade. I couldn’t enter because by the time I noticed the entry signal, the price had already surpassed my entry point. As one of my rules is, I only open a position when there is a confirmed trend in the market.

The next day, I saw that the coach made a post regarding the PLTR entry, and another coach noted that his entry falls within the range of $172 to $176. I didn’t feel any FOMO since I couldn’t take the trade, but I asked myself why they entered.

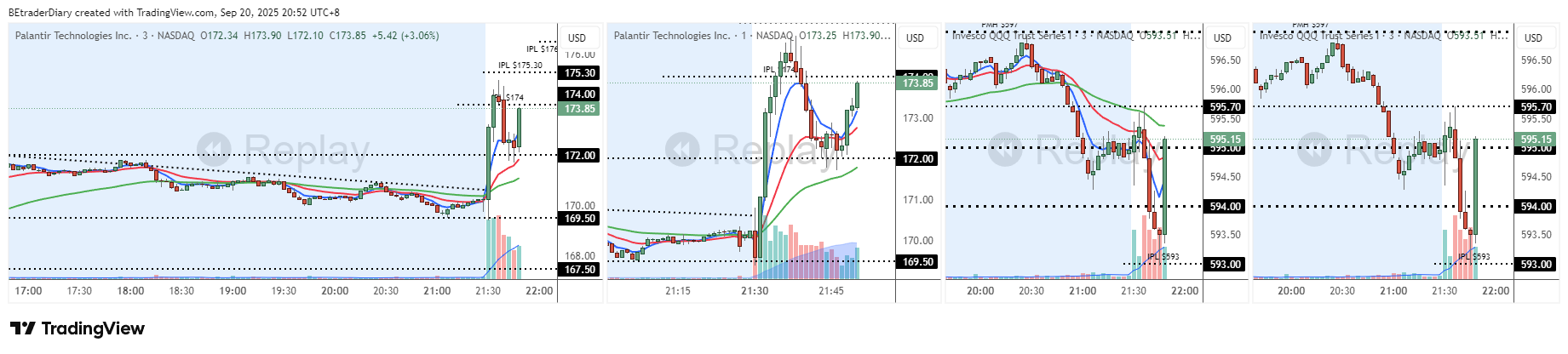

I believe their conviction seems to have originated from observing QQQ’s shift to a bullish trend after the hammer pattern formed at the ITL level of $593, plus PLTR also showing a P3 entry. I saw the same, but I was waiting for QQQ’s next candle to confirm. For them, it seems the hammer in the QQQ itself was enough to trigger the entry.

And my ITL level on QQQ and PLTR matches the coach’s, confirming that my support and resistance levels are accurate.

Looking back, I usually set my bias on today’s 3-minute chart of the market to gauge the trend. But in PLTR’s case, I should have also factored in the broader intraday trend from the pre-market and previous days. The trajectory of QQQ showcased a rise, followed by a phase of sideways consolidation, yet it continued to reflect an overall bullish trend. The pullback, in this context, looked reasonably healthy. So with this, once the hammer is formed, it is considered a bullish reversal, and I can enter a position.