Sell on Good News

Sell on Good News is a stock market adage where investors sell shares immediately after positive news is announced. The logic is that markets often price in expectations ahead of time, so when the good news finally arrives, the stock may already be at a peak. As a result, traders take profits, sometimes causing the price to drop despite the positive announcement. This reaction reflects the idea that markets move not just on news, but on how that news compares to what was already anticipated.

Company with Good Earnings

For an example in July 2023, Apple reported quarterly earnings that beat Wall Street’s expectations, showing stronger-than-expected iPhone sales. At first, the stock jumped in after-hours trading because the results looked very positive. However, the next trading day, Apple’s stock fell because investors had already priced in strong performance beforehand, and many traders used the “good news” as an opportunity to take profits.

This shows how even when the fundamentals look great, the market reaction can be the opposite—because sentiment, expectations, and profit-taking behavior drive short-term price moves.

Market is Overstretched

“Sell on Good News” is also especially common when the market is overstretched—meaning prices have already run up strongly and valuations are high. In such cases, investors are more likely to take profits once good news is released, because:

- Expectations are already priced in – if everyone expects strong results, the news often doesn’t push prices higher.

- Valuations are rich – traders see limited upside and use the good news as a liquidity event to sell.

- Sentiment is euphoric – in overheated markets, even excellent news can’t justify further rallies, so selling pressure dominates.

This is why you often see stocks or indexes drop after earnings beats or strong economic data when markets are at record highs.

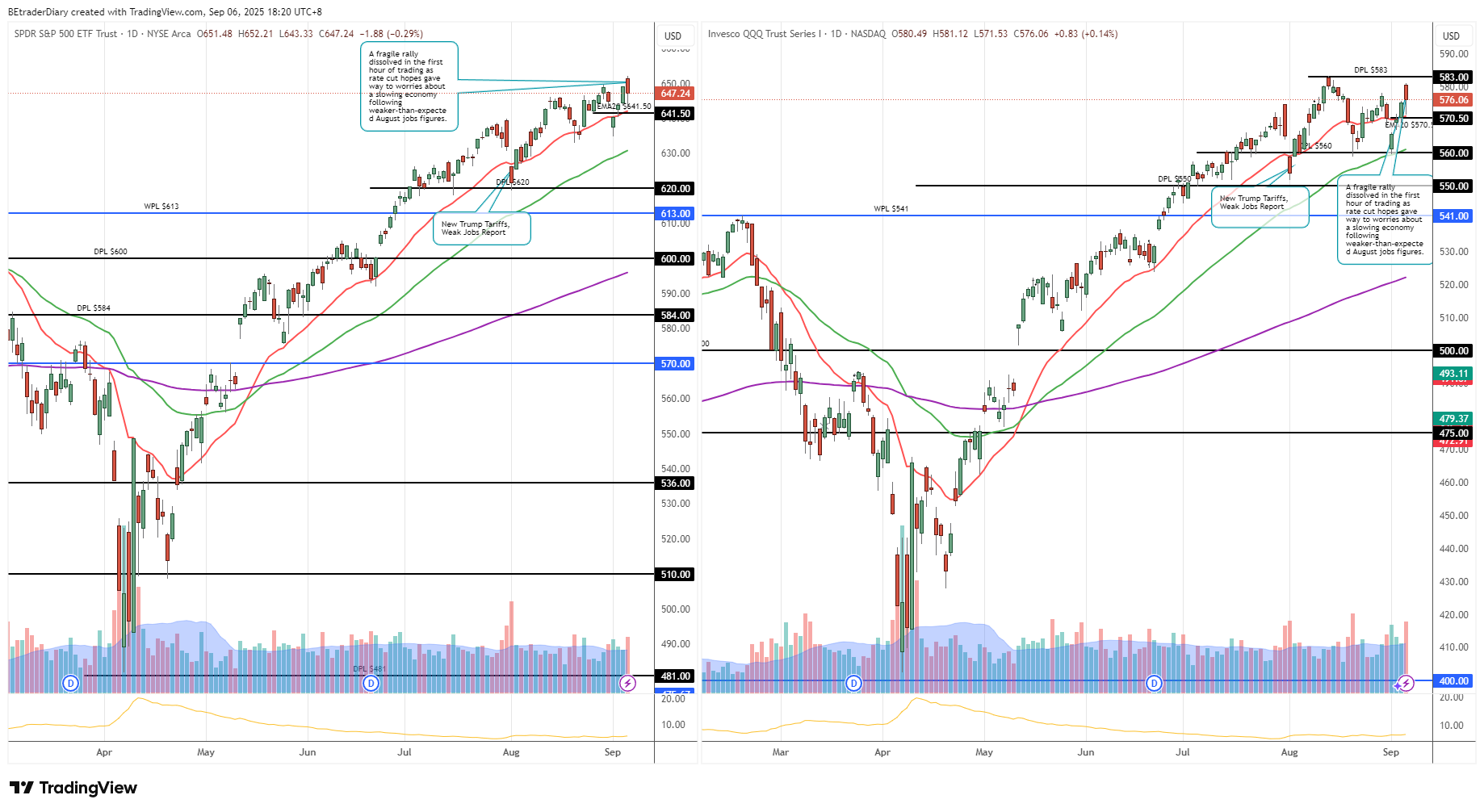

Weak August Jobs Report – Rate-Cut Optimism

On Friday, September 5, markets reacted positively to a much weaker-than-expected U.S. August jobs report: only 22,000 jobs were added versus forecasts of 75,000+. The unemployment rate ticked up to 4.3%, its highest since 2021.

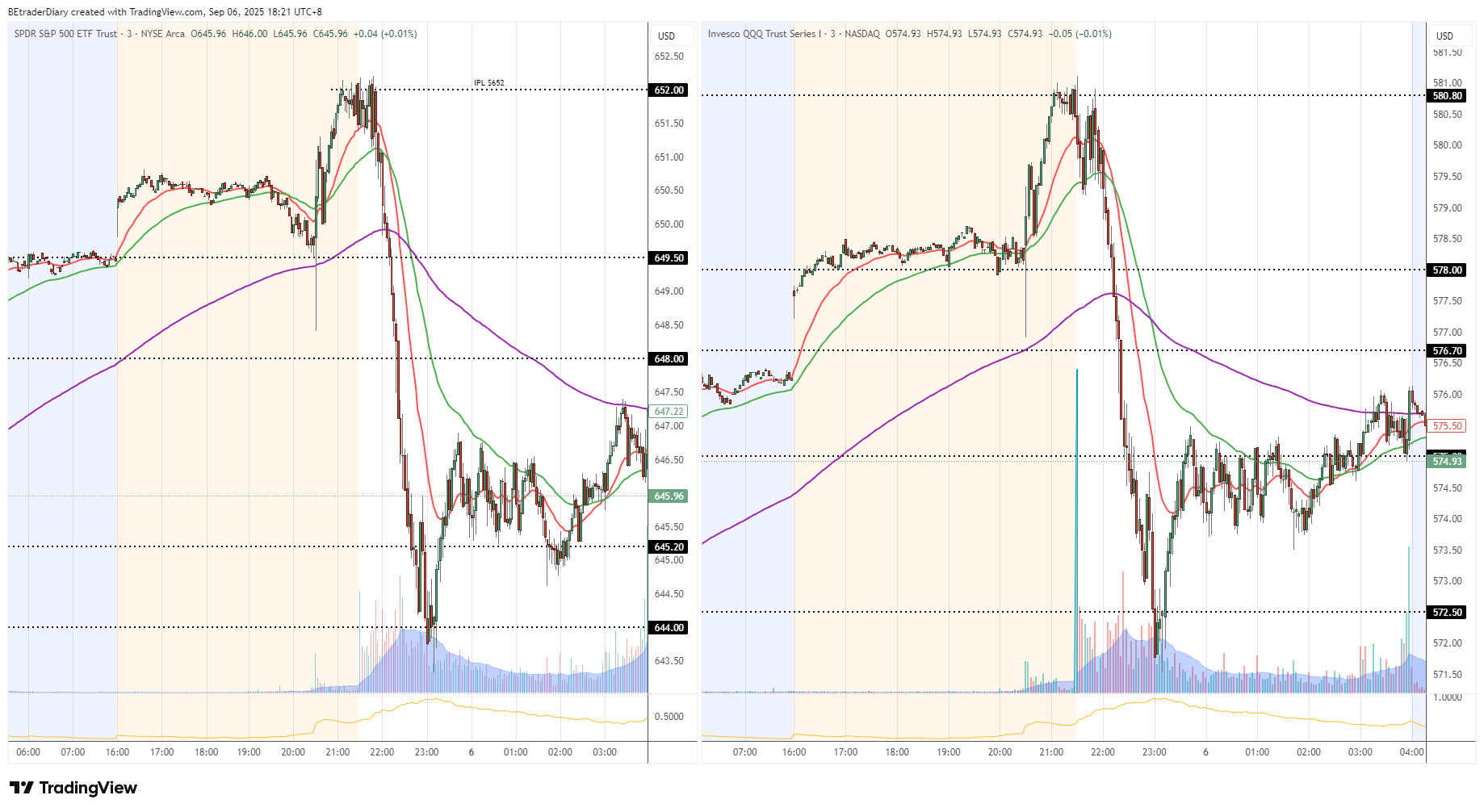

Markets interpreted the softness as a green light for imminent Federal Reserve rate cuts—including a possible 50 basis point cut in September. This report majorly boosted market sentiment and S&P 500 futures rose, and the S&P 500 hit a record intraday high. Refer to the intraday chart below which I capture from my favourite charting platform, TradingView.

After market open, market have been like consolidating for 20 to 30 mintues and not able to break above the intraday resistance. Then market start to sell-off till 11 am (US time) before it rebounce and consolidating.

When the non-farm payroll (Non-Farm Employment Change) released at 8.30 am (US time), only 22,000 jobs created and it is much lower than 75,000 forecase and the previous month of 79,000 jobs created. I feel that this will give Fed more reason to cut interest rate but 22,000 jobs creation is much lower.This prompted me to think about what been told to us during VTP workshop and Intraday workshop by Beyond Insights on sell-on good news. The possibility of Fed to lower the interest rate (good news), investors/traders might come in to open long position. This is where the big fund, investors or traders can offload their positions.

I was monitoring the market, and a bit hesitate to open any position until a clearer trend is confirmed.

Disclaimer

The information provided is for informational and education purposes only. BEtraderDiary.com makes no representations or warranties as regards the information, including but not limited to any representation or warranty as to the accuracy of the information for any specific purpose. While every effort has been made to ensure the accuracy and reliability of this article, the information should not be used to make important financial, investment, real estate, or legal decisions. This information shouldn’t replace advice from a qualified professional who understands your situation. We are not liable for any damage if you use this guidance.